Business partnerships are formed all the time. But partnerships negotiated from start to finish in less than 30 days? Some might say it’s downright unheard of. Which is why Richard Moore can’t help but marvel at the gym franchise Planet Fitness and its new partnership with TSG Consumer Partners LLC.

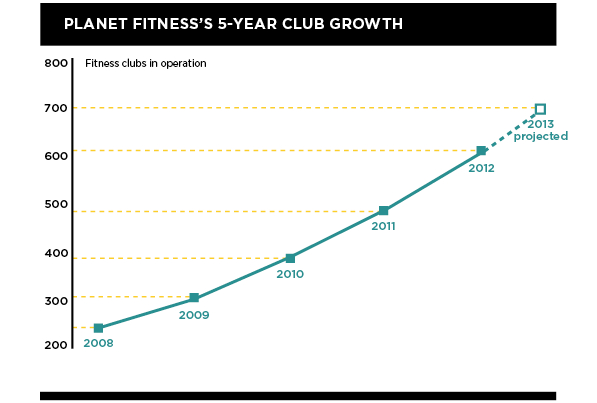

Moore is currently general counsel and chief administration officer for Planet Fitness, though he first learned of the company’s needs while working for the law firm Ropes & Gray LLP a few years ago. At the time, he recalls, the owners of Planet Fitness only had 49 people in the corporate offices but found themselves with approximately 500 clubs, approximately four million members, and some big decisions to make.

“They needed to learn how to work the infrastructure to handle the growth,” Moore says. “They wondered, Do we sell to a bigger company? Partner with a private-equity firm? Take it public? They knew they needed to invest in people and systems … so what we did was help them think through the different options.”

Started more than 20 years ago, Planet Fitness built its high-quality, no-frills brand on a foundation of encouragement and fun that’s as recognizable as its purple and yellow logo and diverting slogans (“Judgment-Free Zone;” “No gymtimidation, No lunks”). So when considering private-equity firms as partners, it was critical to find a firm that “got” Planet Fitness in general.

“They needed a firm that understood what made Planet Fitness great,” Moore explains, “one that they could trust not to damage the brand as they assisted in growing the brand.”

Co-owners Marc Grondahl, Michael Grondahl, and Chris Rondeau were “very savvy,” says Moore, and had a good sense of what they needed from a private-equity firm in order to form a partnership. But he estimates they’d met with over a hundred different firms by the time he began working with them.

“The value I added for them was to let them see there were private-equity firms out there that matched both their cultural fit, and the type of investment they were looking for,” Moore says. “They hadn’t really met any of those.”

Read more of Profile’s Top 50 articles.

TSG Consumer Partners, a private-equity firm in business for more than 25 years, turned out to be the best fit for Planet Fitness. Moore likes to think his most important role—once the negotiation began—was in helping both sides remember it was important to still want to work together when all was said and done. “So I urged the first draft of the agreement to be fair, not lopsided to one side or the other, and needing six months to get to the middle,” he recalls. “I said, ‘Guys, just write something that’s in the middle, and then get it to me.’ That was my challenge to them, and they did a great job.”

In fact, a different kind of partnership emerged when Moore was eventually offered, and accepted, his position at Planet Fitness. It came after years at Ropes & Gray negotiating deals, completing them, and moving on to the next one—something Moore found himself reluctant to do in this particular case.

“With the opportunity at Planet Fitness, it wasn’t just concluding the deal,” he points out. “It was a chance to ask what do you do next? How do you build this relationship and this business? And that was extremely attractive to me—to stay with this deal and build out the team.”

Consequently, the internal expansion has come along rapidly since Moore came on board. From the public relations director to the head of franchising to the vendor compliance executive hired to improve pricing on all goods the franchisees are required to buy, the invest-in-people-first approach has already taken firm root in Moore’s early days with the company. In fact, nearly 15 employees have joined the fold during the early months of 2013.

The improvement and updating of systems, in an effort to streamline business efforts, form another priority for Moore. He’s currently at work on a franchise-management system intended to streamline orders and aid in better understanding membership trends. Improved e-mail portals are on the way as well, part of a general understanding Moore has that the corporate offices need to listen to the company’s franchisees.

“We’re looking more now at helping multiunit owners achieve their goals, and having the best practices bubble up,” Moore says. “We’re in corporate, but that doesn’t mean we know everything.”

“All of this is in an effort to ready Planet Fitness for tomorrow,” Moore continues. “Not when we have 650 clubs, but 1,500 clubs. And how to do that responsibly, in a way that doesn’t tax the system or tax our corporate offices, so that we’re able to continue to provide high-quality services to our franchisees.”

These days, the original co-owners continue to partially own and remain actively involved with Planet Fitness: Michael Grondahl as board member, Rondeau as CEO, and Marc Grondahl as CFO and “trusted adviser to the company,” says Moore.

The revised roles further reflect the win-win vibe of the partnership decision. “A part of it was getting a sense in their own minds—were they finished [with the company]? Were they happy? Yes, they were going to make a ton of money [if they sold to a strategic partner], but were they ready to walk away?” Moore says. “So they realized that nope—they weren’t ready to walk away. That means you have to partner with someone you really want to work with on a day-to-day basis.”

With TSG as the private-equity firm of choice, and Moore now in place as the counsel of choice, Planet Fitness looks to be in great company as it plans the opening of around 50 more clubs nationwide by the end of 2013—bringing the total count to more than 700 units. Moore takes pride in his part of making the big picture that much clearer to see when it was time for both parties to sign on the dotted line.

“Having me here as their in-house counsel, being that point person with Ropes & Gray, LLP as outside counsel to both Planet Fitness and TSG, helping all parties get to the finish line … that allowed Planet Fitness and TSG to focus on building the relationship,” he says.