Steven Kaye knows all too well what can happen to a family without a financial plan. It’s his own personal experience that led him to want to ensure that others had someone they could turn to for advice and planning. “My father died at 57, then a year later, my brother died at 35,” Kaye says. “My mother was widowed without financial security; my two younger siblings were left without a college fund; and I had a father-in-law who had early onset Alzheimer’s and spent nearly 10 years in an expensive nursing home.”

This experience, coupled with a natural entrepreneurial drive and spirit, led Kaye to launch American Economic Planning Group in 1980. Now called AEPG Wealth Strategies, the company is a registered investment adviser, a fiduciary, rather than a broker-dealer, and is fee-based rather than paid by commissions. “There are no underlying self-serving benefits, and we always have the client’s interests first,” Kaye says. “It’s all about doing what’s right for the client.”

This experience, coupled with a natural entrepreneurial drive and spirit, led Kaye to launch American Economic Planning Group in 1980. Now called AEPG Wealth Strategies, the company is a registered investment adviser, a fiduciary, rather than a broker-dealer, and is fee-based rather than paid by commissions. “There are no underlying self-serving benefits, and we always have the client’s interests first,” Kaye says. “It’s all about doing what’s right for the client.”

The Warren, New Jersey-based firm manages about $750 million in client investments and offers a full range of services designed to improve clients’ financial security, including retirement planning and 401(k) plan management, group benefits, and life and health insurance. The company’s key differentiator is that it offers “ultra-high-net-worth services” to high-net-worth individuals—those with $1 million to $10 million in investable assets. “We have specialists on staff in virtually every area a client would need, except where we partner with other experts; e.g., for estate documents, property and casualty insurance, and tax returns,” Kaye says. In addition, AEPG offers “big company” benefits to smaller companies, including employee benefits, group insurance, voluntary benefits, pension plans, and 401(k) savings accounts. It also is an owner in the National Advisors Trust Company, which allows it to offer trust services for a fraction of the typical cost.

AEPG’s latest service offering is the launch of private client websites (secure “client vaults”) branded myWealthStrategies, in which AEPG’s on-the-go clients can aggregate accounts and data, and can keep critical documents and information, including wills, financial plans, investments, passports, airline miles, and credit-card statements. The area is so private that AEPG staff don’t have access to it unless the client gives them express permission, and even then, the client can give them permission to some documents and not others.

The company also offers a unique investment strategy. “Our model provides diversification when everything else in the industry is falling apart,” explains Mark Ukrainskyj, chief investment officer. The strategy has two sides: lower-risk and risk-based. The lower-risk side consists of treasury bonds. The risk-based side is split into two areas: core global equities and satellite. The core is indexed to the global stock markets to provide low-cost exposure to world markets. The tactical satellite portion is more opportunistic, with investments selected after thorough research, with specific entry and exit points and risk-management parameters.

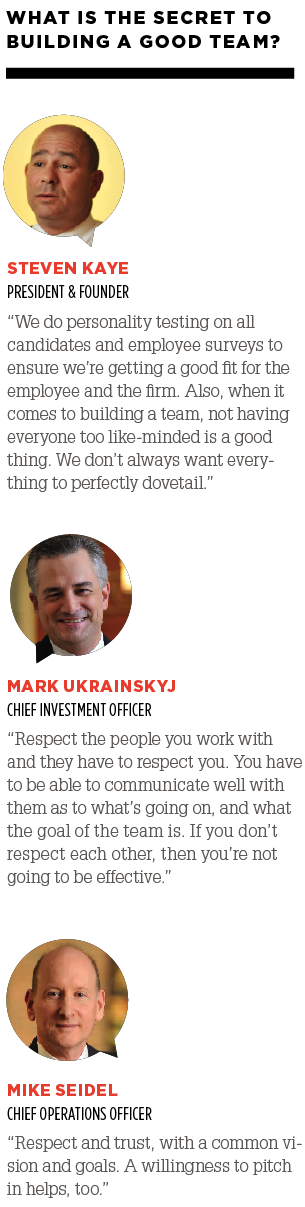

Key to great service and well-planned strategic decisions is great staff, which AEPG considers its most valuable asset. “We treat them accordingly, with above-average compensation and benefits,” says Kaye. The company recently added a sabbatical policy of one month paid time off after 10 years of service. They offer a work-at-home policy, flexible hours, and have staff-appreciation events. “Our work ethic is all about results,” Kaye says. “It’s not about watching the clock.”

AEPG’s flat organizational structure also gives staff opportunities to develop, grow, and assume increasing responsibilities. “We give [employees] a good amount of responsibility and mentor them,” says Mike Seidel, chief operations officer. “If they do a good job, they can take on increasing responsibilities and move their compensation up significantly, even in a down financial market or a rough employment market.” Management also encourages staff to continue their education, pursue advanced degrees, attain important industry credentials, and be active in industry groups. As a measure of AEPG’s success, Kaye has been featured on Morningstar more than any adviser. Members of AEPG’s team have been on CNBC and other shows more than 50 times, and they speak frequently at industry symposiums.

Thankful for its accomplishments, the AEPG team also gives back. One charity close to the firm’s heart is the Joseph E. Enright Foundation, which promotes health through education. Kaye, who is its secretary and treasurer, received the Kingfisher Award for outstanding service with the organization in 2010. AEPG also supports Make-A-Wish, Doctors Without Borders, Smile Train, and other philanthropic groups.

With AEPG’s unique wealth-building strategies, elite services, and culture of giving, Steven Kaye can rest assured that the clients the firm serves will be better prepared than his family was for whatever life might throw their way.