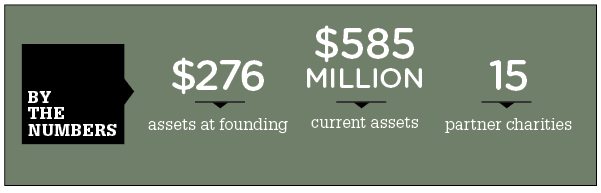

Red River Federal Credit Union had an inauspicious beginning, with just $276 in assets among 27 members, but you’d never know that today. It currently serves 64,000 members located in every state of the union and virtually every country in the world. “Our members are extremely loyal,” says John Stephens, senior vice president. “They join when they live in our community, but stay long after they’ve moved away.”

Such loyalty, in part, is due to the nature of a credit union, which is a financial cooperative owned by its members. Service is highly personalized, and any money made after operating expenses is returned to members in the form of lower loan rates and higher investment returns. “Credit unions were established to give the community served the best possible deal,” Stephens says.

That was certainly the case with Red River Federal Credit Union, which was founded in 1943 to serve the employees of the Red River Arsenal, now Red River Army Depot, which is a defense installation that initially supplied armed forces with ammunition in the 1940s and now serves as a maintenance repair facility. “We started with 27 people who were dissatisfied with the interest rates available at banks and decided to apply for a federal charter, pool their life savings of $276, and opened a credit union in a small office on the depot grounds,” Stephens says. “They put their money in a cigar box and would loan each other money out of that box.”

What a difference a few decades make. Today, Red River Federal Credit Union is chartered to serve new members who live, work, worship, or attend school in 12 counties near the Texas and Arkansas boarder. Although 85 percent live within a 100-mile radius of the union’s headquarters in Texarkana, Texas, 15 percent are long-distance customers. “We’re totally electronic, so you can do business with us via computer or telephone,” Stephens says. “The only reason you’d ever need to step into a branch is if you want a real-estate loan.” Clearly, the community likes what Red River Federal Credit Union is doing. Its $276 in starting assets have growth to $585 million today—making its cumulative growth an astounding 16,300,121 percent.

In keeping with its emphasis on community service, Red River Federal Credit Union is dedicated to charitable endeavors, many related to financial literacy. “We have five high-school branches with kiosks in their cafeterias, and we train and hire two students from each high school to run those branches before and after school and during lunch,” Stephens says. “In exchange, the high schools let us come into classrooms and teach financial literacy. What’s a checking account? Why is a budget important? How do you keep your credit report clean? Most parents don’t have time to do that, and we feel that it’s important.”

The credit union is also involved in a number of other charities spanning virtually every sector: The American Red Cross, Junior Achievement, Special Olympics, American Cancer Society, Literary Council, and Susan G. Komen for the Cure, to name just a few. “This is a rural area of eastern Texas, with probably 250,000 people in the area, and we’ve raised hundreds of thousands of dollars over the years to help them,” Stephens says.

According to Stephens, the secret to the credit union’s success is all about community—its employee community as well as its member-owners. Many employees have been with the union for decades, including CEO Robert Buck, who started as a teller 39 years ago, and Stephens himself, who has been with the union for 29 years. It’s not surprising that in 2011 the Principal Group selected the bank as one of the 10 best companies for employees’ financial security in the country. Red River Federal Credit Union’s service mentality, however, also extends outward. “Our philosophy is to do what’s right by our member-owners, serving their every financial need,” he explains. “We want to be their primary financial institution; we want their checking accounts, savings accounts, home loans, car loans, business loans, IRAs, credit cards. It’s very simple, but it’s important.”