TTX, the railcar pooling company founded as Trailer Train in 1955 by the Pennsylvania Railroad, continues to reap the benefits of its early investment in a new technology—flatcars that would haul highway trailers. In 1974, TTX proposed a “pooling agreement” as more and more rail carriers invested in the company. The pooling of railcars allows leading railroad companies to reduce capital investment and financial risks, and improve operational efficiencies, since the railcars can be returned to TTX when no longer needed, streamlining the number of railcars in each haul. That collaborative effort powered TTX to the top of the industry as the largest owner of railcars in North America.

WHAT IS POOLING?

Think of it like a carpool for commuters—but for trains. The concept of TTX’s railcar pooling maximizes the efficiency of North America’s leading railroads by sharing a set amount of railcars, which collectively saves time, costs, and fuel waste.

Each railroad company can use the pooled railcars as if they were their own, interchangeably. This means that when any railcar is unloaded, instead of being hauled back to its point of origin for another round, the railroad company can use a TTX railcar at its current location to reload and reroute to any other destination to transfer the load accordingly.

Since pooled railcars handle more loads with fewer railcars, TTX’s railcar fleet—more than 220,000 cars and intermodal wells—saves railroads a quarter-billion dollars in operational costs each year, according to the corporate website, saving $12 billion in assets and $700 million a year in maintenance.

Pooling is the railroad’s equivalent to the coworkers’ carpool that saves each person gas money, and limits the number of empty seats and unnecessary cars polluting while on the road. In that sense, railcar pooling minimizes a railcar’s total empty miles, which translates to lower costs, a stronger green footprint, and fewer industry risks for railroad companies overall.

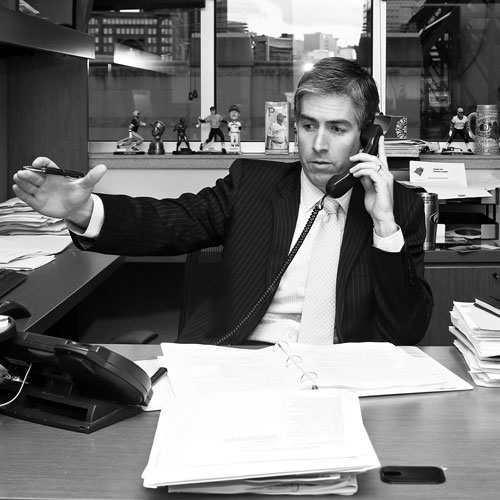

Straight-talking Vicki Dudley, vice president, chief financial officer, and treasurer of TTX, knows what it takes to keep the company on its fruitful track. The company manages the North American boxcar pool and autorack pool, but she explains that the bulk of TTX’s business is in intermodal (shipping containers and trailers) and hauling finished automobiles. “TTX provides a pool of railcars to our owners to help them reduce the money that they have to invest and reduce their risk of ownership while helping them minimize empty miles,” Dudley says.

TTX provides many of the boxcars, but other leasing companies can contribute if one of the signers to the pool sponsors the cars. “Our mission is really to give them the right car at a very high-quality standard at the lowest cost possible,” Dudley says. “Unlike a public company that’s just a pure for-profit company, our goal is not to make as much money as we can, but enough to maintain our high credit ratings. So we say we’re not a profit maximizer, but we’re a profit optimizer.”

Dudley joined TTX in October 2012 and is responsible for raising capital, investor relations, insurance procurement, financial reporting, financial planning and forecasting, as well as corporate tax—to name a few. She’s also changed the culture at TTX with her staff of seventy-five financial professionals. “One of my goals is to move finance from being the reporter of what happened to driving improvements throughout the business by providing analytics and consultation,” she says.

Under her guidance, the finance department turned into a more proactive team that has transformed the traditional focus of reporting and number crunching into a dynamic sector of TTX that forecasts, finds efficiencies, increases investor confidence, and makes the company nimbler and more resilient to the ups and downs of the industry.

The changes have yielded visible results. The quality and cost of TTX’s corporate insurance improved with costs reduced by almost 6 percent while the amount of coverages increased, according to Dudley. “We entered a captive insurance program for our worker’s comp and auto insurance, and we’ve also greatly increased the number of insurance companies that are willing to provide our excess liability insurance coverage,” she says. “And because we’ve added additional insurers and educated the insurance companies about what we actually do and what our risks are, the cost has also decreased there.”

Dudley’s team also significantly reduced the cost of borrowing through more investor outreach. “When I joined TTX, we were not aggressively talking to investors about what TTX did and were not clear about the appropriate benchmarks for our debt,” she says. “So what we’ve been able to do is to more clearly explain our value proposition and greatly increase investor interest in our debt, which has reduced the premium that we’re paying to comparable entities.”

Another part of TTX’s business scope is keeping its pool of railcars in tip-top shape with maintenance centers across the United States. With more than $6oo million a year in maintenance outlay, it’s a major influence on TTX’s business decisions. “We now have better tools to analyze in much greater detail our maintenance spending,” Dudley says. “Maintenance is a very significant part of the use of our revenues. We’re implementing better statistical tools to help improve forecasting and a lot more analytics to enhance our understanding of how we’re spending our money.” TTX generates more than $1.5 billion in revenue per year.

Dudley sees the finance department as a critical part of the whole. The business involves multiple systems and a significant amount of transactions all over the company, according to the CFO. “If there is a failure in one of those systems or transactions, it gets discovered in finance,” she says. “We want to stop the errors before they arise, so we’re involved in a lot of overall corporate initiatives, particularly on the technology side, trying to help improve our efficiencies, controls, and tools to help improve our ability to analyze data.”

TTX’s finance team kicks into high gear when using the numbers for holistic applications, as evident by their involvement in the significant business intelligence and data improvement company wide.

Yet, Dudley’s team continues to seek the next solution. “We’re on a journey,” she says. “We have continued work to do to enhance our metrics and analytics. That’s definitely going

to be the focus over the next couple of years.”