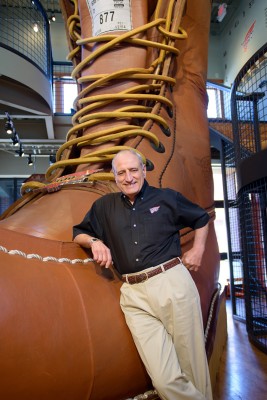

When I first started interviews for the position at Red Wing Shoes, what I found among the people was a tremendous passion and pride for the company—not only the brand, but also the heritage. There is such a bond between the company and the community of Red Wing, Minnesota. Generations of families have worked for Red Wing Shoes. You find people in the manufacturing plant who have been there for up to fifty years and maybe their sons work there too, and their parents did or even their grandparents. It is not just a job for these people: it’s a lifestyle. The people love this company. Ultimately, that is why I took the position.

At that time, Red Wing Shoes was a very inward-looking finance organization. There was no real relationship between finance and management. The CFO reported to the chairman of the company.

I came in reporting to the president and became a more important person on the management board from a strategic business partnership perspective. I needed to understand the needs of the business, its pain points, what leadership needed to drive the business, whether investments were required—and I adjusted the finance organization accordingly.

I brought in people, especially in the financial planning and analysis (FP&A) group, who became partners to each of the division heads—strategic business partners helping run the business and drive results versus just performing accounting tasks. This group is led by Chris Gullickson, director of FP&A. Previously the finance organization was just an accounting shop, so we changed that. The relationship between finance and both the management and the board of directors was adverse. Upon joining the company, I tried to change that whole culture completely.

At that time, the company did not think about capital management, and we brought in better reporting as well as more dashboards. We made accountability for results—especially cash management—a lot stronger. A lot of emphasis was placed on managing cash, putting it in the right places, and making the right investments. I was also looking strategically at business development. I formed a business development board, initially chaired by finance, looking at strategic opportunities for the company going forward. That board has now evolved into a board that makes all key decisions within the company and is led by our chief operating officer. Over time, the whole outlook of finance changed within the company; people now see finance as a valuable resource instead of an adversary.

When building the finance team I wanted to bring in people who have the skill level to do the job, but also shared the passion for Red Wing Shoes. We have a Heritage division for example, which is our fashion line based on our work shoes, and we needed a financial head. So the person we brought in (Nick Carlson, senior financial analyst) really fit the image of someone who wears Heritage shoes and had a really strong passion for the brand. It was the same for our Vasque line, which is our recreational line that includes hiking boots and trail running shoes. The person we brought in (Brian Jacobson, senior financial manager) is a passionate hiker and biker. And he fit very well with the head of the Vasque division who is very similar in mind-set. So these people are not only doing their job of analyzing numbers and reporting, they also have a passion for the business, so they are going to find ways to help drive growth.

In manufacturing—in addition to our divisions in Work, Hunt, Retail, Heritage, and Vasque, we also have a tannery and two US manufacturing sites—there wasn’t a supply chain finance function to speak of. There was no one reporting to the heads of manufacturing, so I brought in the director of supply chain finance (Jean Lodermeier). Now we are hitting high productivity. We still make a significant amount of our shoes in the US—40 percent. Currently 99 percent of shoes that people wear are made outside of the US—so we brought in finance people to help support productivity, to drive down costs as much as possible and improve our margins. None of that existed before.

Along with this restructuring, I have led the acquisition of a major supplier to the North Sea oil industry based in Aberdeen, Scotland. One of our sweet spots, along with footwear, is that we’re a major supplier of personal protective equipment and garments to the oil industry. Since making the acquisition two years ago, that division is growing by 25 percent a year. We also set up a sister company on the other side of the North Sea in Stavanger, Norway. Our international business has grown from 15 percent to 25 percent of our revenue. A lot of my background is in building business outside of the US. I brought that skill set

to the company, which has included the establishment of several new subsidiaries like those in the Netherlands, Luxemburg, Norway, the UK, Canada, and Mexico.

I also took a look at our entire pension program. We were in a high-risk area there. We put the pension plans on a de-risk glide path to reduce our liabilities and secure the assets going forward. Previously it was too equity focused versus fixed income. We’ve changed that and it has shown significant improvement.

Finance should be a strategic partner to the business: the finance department is comprised of the people you are going to rely on as a voice of reason, the people who are going to be protecting the company’s assets in addition to looking out for the company’s future, and on the other hand, the people who are willing to take calculated risks in order to drive the business forward. One of the beauties of Red Wing Shoes is that it’s a private company. Private companies can make decisions over the long term, whereas public companies make decisions on a quarterly basis. We don’t have those fears, so we can make rational business decisions that are good in the long run for the company.

Today Red Wing Shoes is a $730 million business. We’ve grown double digits on average for the last five years. We’ve grown internationally. We’ve expanded beyond the work division to fashion footwear. We have thirteen stores outside of the US that just sell our Heritage fashion line, besides the nearly 500 stores in the US that sell our work line. We also have approximately 160 industrial trucks that travel around the US—mobile shoe stores that go to industrial sites, then pull down the back door and become a shoe store. We’re a very unique, vertically integrated company. We tan our own leather, so the raw materials come from our own source.

After being here for five years, I feel blessed to be a part of Red Wing Shoes, to feel the pride I have when I wear the shoes and speak about it. We’re a well-respected and loved brand. Especially in Minnesota, where we were recently voted the most loved brand in the state by the Minneapolis/St. Paul Business Journal Brand Madness Competition. That, along with being part of the Red Wing family, is what excites me.